Johnson County’s Residential Properties Have Seen A Remarkable 12.6% Jump In The 2024 Reassessment!

O'Connor seen a remarkable 12.6% jump in the 2024 reassessment for Johnson County’s residential properties.

DALLAS, TEXAS, UNITED STATES, July 29, 2024 /EINPresswire.com/ -- Johnson County Residences Rose In 2024

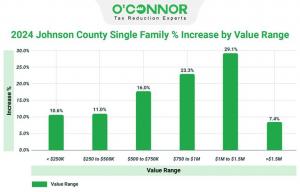

The Central Appraisal District of Johnson County reported a 12.6% increase in assessed values for single-family homes across the board in 2024. Luxurious homes, particularly those valued between $1 million and $1.5 million, saw the most substantial increase of 29%, while homes priced from $750,000 to $1 million also experienced a significant rise of 23.3%. Across all value ranges, there was a widespread increase in assessed values regardless of the property’s value range.

In Johnson County, homes ranging from 4,000 to 5,999 square feet saw a notable 22% increase, underscoring the rising market value of spacious living. Conversely, grand-sized homes exceeding 8,000 square feet experienced a more conservative rise of just 8.6%.

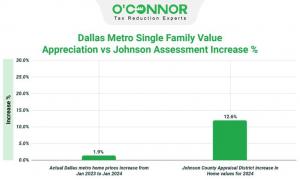

Johnson County’s Single-Family Values Surpass Those of the Dallas Metro Assessments

Across Johnson County, residential property values saw a significant 12.6% rise in the 2024 reassessments, according to The Central Appraisal District of Johnson County. In comparison, the Dallas Metro Tex Association of Realtors reported a 1.9% increase in assessed property values in the Dallas Metro area from January 2023 to January 2024.

Increase in Property Assessment Growth Rates for Single-Family Homes Based on Year Built

The Central Appraisal District of Johnson County’s 2024 property tax reassessment revealed that properties without specific construction years, or labeled as “others”, saw the largest percentage increase in assessments. The assessed value of this category surged by 19%, rising from $697 million to $830 million. Additionally, properties built after 2001 experienced a significant increase of almost 16% from the reassessment.

Let’s analyze how the 3,473 accounts in Johnson County were assessed based on their 2023 home sales prices compared to their 2024 property tax reassessment values. The data reveals significant findings: 57% (1,972 accounts) were assessed higher than their 2023 sale prices, while 43% (1,501 accounts) were valued at or below their 2023 sale prices.

Insights from the Central Appraisal District on Johnson County’s 2024 Property Tax Reassessment

Johnson County’s residential property market outpaced the Dallas metropolitan area, with homeowners facing a substantial increase in property values. In private discussions, some homeowners have acknowledged recent rises in their property values. The increase in interest rates, rising from 1.71% in January 2022 to 4.05% in January 2024, is likely a primary contributing factor. This issue has been further compounded by consistent revenue patterns and ongoing increases in casualty insurance and other operational expenses.

Optimize Savings with Annual Property Value Reassessments

Homeowners in Texas, particularly those residing in Johnson County, have the right to challenge their property assessments. Throughout the appeal process, residential and commercial property owners can present evidence to contest assessments they believe are excessive. Pursuing an appeal or consulting with a property tax specialist often yields successful results, as many protests are resolved favorably. With over 50 years of experience, O’Connor is a trusted advocate for both residential and commercial property owners in legal matters. O’Connor is committed to enhancing the quality of life for property owners by achieving fair tax reductions through their extensive resources and expertise.

About O’Connor

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 900 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™. There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+ + +1 713-375-4128

email us here

Visit us on social media:

Facebook

X

LinkedIn

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.